GOLD : $ 5212.50 US/ounce SILVER : $ 86.79 US/ounce

COPPER : $ 5.78 US/pound ZINC : $ 1.65 US/pound

GOLD : $ 5212.50 US/ounce SILVER : $ 86.79 US/ounce

COPPER : $ 5.78 US/pound ZINC : $ 1.65 US/pound

GOLD : $ 5212.50 US/ounce SILVER : $ 86.79 US/ounce

COPPER : $ 5.78 US/pound ZINC : $ 1.65 US/pound

Horne 5 Project

At a Glance

Mineral reserves |

80,896,876 tonnes (2,24 g/t Au Eq) |

Deposit depth |

650 m to 2,000 m from the surface |

Dimensions of the deposit |

Length greater than 1,000 metres. |

After-tax net payable value (“NPV”)5% |

US$M 761 |

After-tax internal rate of return (“IRR”) |

18.9% |

All-in sustaining costs (“AISC”) |

US$ 587/oz |

Capital costs |

US$M 844 |

Operating costs |

C$43.11/tonne milled |

*2021 Updated Feasibility Study

Links

CORPORATE VIDEO

Horne 5 virtual portal

CORPORATE PRESENTATION

2021 UPDATED FEASIBILITY STUDY

Project Description

To learn more on mineral reserves and resources, the deposit, the pre-production capital costs, the operating costs, the payable metal value split, mining, metallurgy and sustainability, please consult the Corporate Presentation of the Horne 5 Project.

Feasibility Study

The feasibility study of 2017 was updated in 2021 to reflect the improved commodity prices, the silver stream financing arrangement with Osisko Gold Royalties Ltd. and the copper and zinc concentrate offtake agreements with Glencore. The capital and operating costs were reviewed to reflect current market conditions for labour, supplies and services.

Highlights

The 2021 Updated Feasibility Study (“UFS”) was prepared in Canadian Dollars (C$). The values have been converted to U.S. Dollars (US$) at an exchange rate of C$1.28 = US$1.00 for the purposes hereof.

Base case economics are stated using a gold price of $1,600 per ounce, silver price of $21.00 per ounce, copper price of $3.20 per pound, zinc price of $1.15 per pound and an exchange rate of C$1.28 equal to US$1.00.

- Net payable value (“NPV”) of $1,279 million at a 5% discount rate and an internal rate of return (“IRR”) of 23.0% before taxes and mining duties;

- Net payable value (“NPV”) of $761 million at a 5% discount rate and an internal rate of return (“IRR”) of 18.9% after taxes and mining duties;

- Average annual gold production of 220,300 payable ounces annually over the 15-year life of mine;

- Low average all-in sustaining costs (“AISC”) of $587 per ounce;

- C$43.11 per tonne processed total unit operating cost;

- Forward capital and pre-production costs of $844.2 million, including 9.2% contingency;

- Conservative mining reserves by maintaining 2017 commodity price assumptions.

https://www.traditionrolex.com/32

Documents

Mineralization

The gold-rich polymetallic sulphide mineralization at the Horne 5 deposit forms a large subvertical tabular body that measures close to 2 km in length, 500 to 850 m across and between 20 to 130 m in thickness. The deposit is hosted in a dacitic to rhyodacitic volcaniclastic and shallow intrusive unit.

The mineralization is composed of numerous pyrite-dominated stacked semi-massive and massive sulphide lenses that locally exceed 10m in thickness. These sulphide lenses are surrounded by extensive zones of altered felsic rocks with disseminated and stringer sulphides.

The ore minerals at Horne 5 deposit are mainly pyrite, with lesser sphalerite, chalcopyrite and magnetite. The mineralization can be subdivided into 5 main types:

- Disseminated sulphides

- Stringer sulphides

- Massive sulphide clasts

- Semi-massive to massive sulphides

- Semi-massive to massive magnetite-chalcopyrite

At the Horne 5 deposit, several observations demonstrate a synvolcanic origin for the gold-rich mineralization (Krushnisky, 2018).

Krushnisky, Alexandre (2018). Controls on Gold Enrichment at the Horne 5 Archean VMS Deposit, Abitibi Greenstone Belt, Québec. Mémoire. Québec, Université du Québec, Institut national de la recherche scientifique, Maîtrise en sciences de la terre, 238 p.

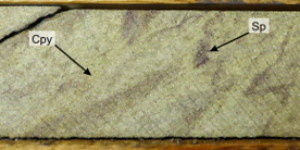

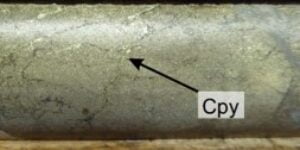

Disseminated: remobilized Py + Sp and Cpy clusters and veinlets

Stringer Pyrite (Py) and sphalerite (Sp, orange-red).

Banding of pale orange sphalerite and quartz

Massive sulphide: foliated and folded bands of Py, Sp (brown) and Cpy

Remobilized Chalcopyrite (Cpy) along fractures within massive Py-Cpy

Critical and Strategic Minerals

In addition to gold, the Horne 5 Project will produce critical and strategic minerals (“CSM”) for the development of Québec’s economy. CSM are essential to the energy transition in order to achieve net-zero greenhouse gas (“GHG”) emissions globally.

Copper (Cu) and zinc (Zn) are identified in the Plan pour la valorisation des minéraux critiques et stratégiques 2020-2025 of the Government of Québec.

- Economic importance for key sectors of the Québec economy

- High supply risk

- No commercial substitutes

Cu and Zn are essential for a transition to a low GHG economy and for the massive deployment of necessary technologies such as solar panels, wind turbines, batteries for electric cars and for the storage of renewable energy, etc.

The achievement of the objective of the Accord de Paris of limiting global warming to well below 2°C, preferably 1.5°C, compared to pre-industrial levels, will depend on the energy transition and will require the use of several metals including Cu, Zn and Ag.

The increased use of CSM is part of a set of solutions to be put in place. Capping and neutralizing global GHG emissions will require a multitude of means, actions and reforms at all levels of the economy and society. This is why the extraction of the minerals necessary for the energy transition must be done with the minimum of impact as well as with respect for the communities and must be guided by the principles of sustainable development.

Over the 15 years of production, the Horne 5 Project will produce:

Relative importance of metals for the technologies necessary for the energy transition (high and medium)*:

Solar – photovoltaic |

Cu, Ag |

Solar – by energy concentration |

Cu, Zn |

Wind turbine |

Cu, Zn |

Hydroelectricity |

Cu, Zn |

Bio energy |

Cu, Zn |

Electrical network components |

Cu |

Electric vehicles and batteries |

Cu |

According to the scenarios, the share of Cu demand for the technologies necessary for the energy transition will be 30% to 45% by 2040. It is currently 24%.

The Cu and Zn concentrates produced by Falco will be processed in Québec thanks to the Streaming Agreement signed with Glencore in October 2020.

- Glencore extracts, transforms and recycles CSM and is a key player in this sector in Québec and elsewhere in the world

- Cu concentrate shipped to Glencore’s Horne Smelter less than 1 km from the Horne 5 mining complex

- Subsequently, the Cu anodes produced in Rouyn-Noranda will be shipped to Glencore’s CCR refinery in Montreal, Québec

- Zn concentrate will be shipped to Glencore’s operated smelters

*Source: https://iea.blob.core.windows.net/assets/ffd2a83b-8c30-4e9d-980a-52b6d9a86fdc/TheRoleofCriticalMineralsinCleanEnergyTransitions.pdf , consulted March 14, 2022

Advanced Exploration

The advanced exploration phase of the project consists of dewatering the old mines, rehabilitating the Quemont shaft and performing underground drilling and bulk sampling of 5,000 tonnes of ore.

This will make it possible to increase the degree of confidence in the resources (convert from indicated to measured resources) and to carry out various mineral and metallurgical tests.

Development work will begin as soon as the permits are obtained and will continue for a period of approximately 25 months.

Estimate of 11 M m3 of water contained in the former Quemont, Horne and Donalda mines:

- 10.8 M m3 to be pumped

- 9.2 M m3 to be treated

- Projected final effluent: Ruisseau Dallaire